In 2023, Ukraine received external financing totaling USD 42.5 billion. USD, of which 11.6 billion 0 USD (or 27 %) was non-repayable grant aid. 0 (or 27 %) was non-repayable grant aid. This was reported by the Ministry of Finance, UNN reports .

Details

According to the Ministry of Finance, 10 countries provided grant assistance to Ukraine, namely: USA, Japan, Norway, Germany, Spain, Finland, Switzerland, Ireland, Belgium, Iceland.

According to the report, long-term concessional loan financing totaled USD 30.9 billion. This included the EU (USD 19.5 billion), the IMF (USD 4.5 billion), Japan (USD 3.4 billion), Canada (USD 1.8 billion), the UK (USD 1 billion), the World Bank (USD 660 million), and Spain (USD 50 million).

Ukrainians received funds from the European Union as part of macro-financial assistance. Loans under the EU macro-financial assistance programs have a 35-year maturity (including a 10-year grace period), and the EU reimburses the costs of servicing them.

As of the end of 2023, the weighted average cost of public and publicly guaranteed debt was 6.24 %, down 1.4 percentage points year-on-year.

At the same time, according to the agency, the weighted average maturity of Ukraine's public and guaranteed debt increased by more than 2 years last year - to 10.56 years.

Overall, in 2023, Ukraine's total public and publicly guaranteed debt increased by UAH 1,444 billion in the hryvnia equivalent and by USD 33.9 billion in the dollar equivalent. The increase was mainly due to an increase in long-term concessional financing from international partners.

As of December 31, 2023, Ukraine's public and publicly guaranteed debt amounted to UAH 5,519.5 billion, or USD 145.3 billion. This includes: state and state-guaranteed external debt - UAH 3 863 billion (69.99 % of the total amount of state and state-guaranteed debt), or USD 101.7 billion. The state and state-guaranteed domestic debt amounted to UAH 1,656.5 billion (30.01 %), or USD 43.6 billion. U.S. DOLLARS.

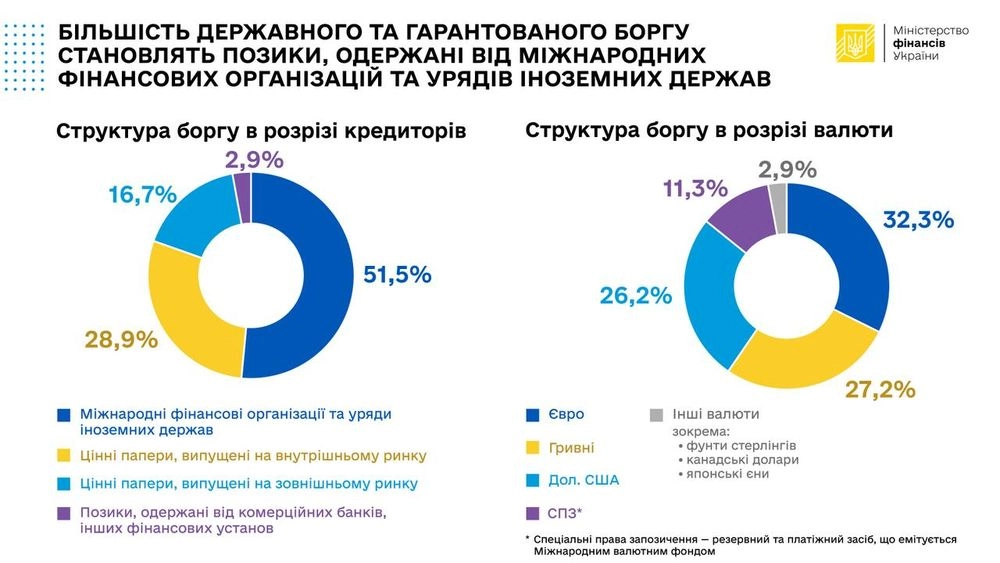

It is noted that in terms of creditors, the lion's share of public and guaranteed debt is made up of concessional loans received from international financial organizations (IFOs) and foreign governments - 51.5 %, securities issued in the domestic market - 28.9 %, securities issued in the foreign market - 16.7% and loans received from commercial banks and other financial institutions - 2.9 %.

In terms of the currency structure of public and guaranteed debt, the share of public debt denominated in euros increased rapidly as a result of EU macro-financial assistance, to 32.3 % from 14% as of the end of 2021.

As of the end of 2023, the share of public debt in hryvnia amounted to 27.2 %, in US dollars - 26.2 %, in special drawing rights (IMF currency) - 11.3 %, and in other currencies, including pounds sterling, Canadian dollars and Japanese yen - 2.9 %.

According to the report, in 2023, the Ministry of Finance held 206 auctions for the placement of domestic government bonds, raising UAH 552.6 billion to finance the state budget.

As of December 31, 2023, the refinancing percentage of market domestic government bonds amounted to 150 %, while the refinancing percentage of domestic government bonds denominated in UAH was 172.6 %, in USD - 111.2 %, and in EUR - 126.4 %.

The current state of Ukraine's public and publicly guaranteed debt is available on the official website of the Ministry of Finance of Ukraine at link.